Understanding Five Star Finance Share Price: A Comprehensive Guide

Investing in the stock market requires a keen understanding of various elements, and one crucial aspect is monitoring share prices. In this article, we’ll delve into the intricacies of Five Star Finance share price, exploring its background, factors influencing its value, and providing valuable insights for potential investors.

I. Introduction

Investing can be a daunting task, but comprehending share prices is fundamental to making informed decisions. Five Star Finance, a prominent player in the market, serves as an interesting case study for investors looking to navigate the complexities of the stock market.

II. Background of Five Star Finance

A. Company History Five Star Finance has a rich history, spanning several decades, marked by milestones and challenges. Understanding its journey provides context for evaluating its current standing in the market.

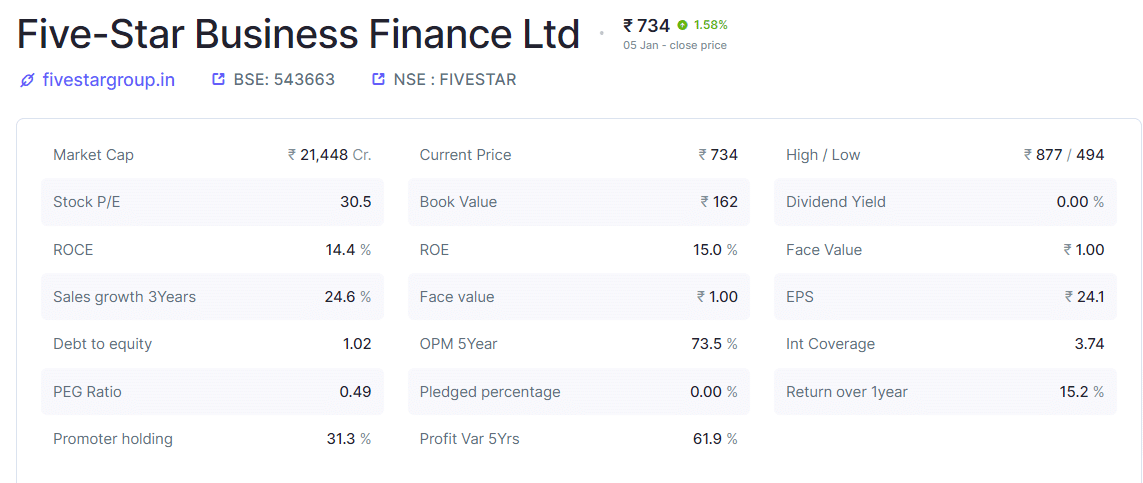

B. Key Financial Highlights Analyzing the company’s financial reports unveils crucial insights into its stability and growth potential, influencing the perception of investors.

C. Market Presence Five Star Finance’s position in the market plays a pivotal role in determining the dynamics of its share price. Market share and competition are crucial considerations for investors.

III. Significance of Share Prices

A. Explanation of Share Prices Share prices represent more than just numbers on a screen; they mirror the perceived value of a company in the eyes of investors.

B. Factors Influencing Share Prices Various factors, from economic indicators to market sentiment, contribute to the fluctuation of share prices. Understanding these factors is essential for predicting trends.

IV. Analyzing Five Star Finance Share Price

A. Current Market Trends Analyzing recent market trends provides valuable insights into the short-term movements of Five Star Finance’s share price, aiding investors in making timely decisions.

B. Historical Performance Examining the historical performance of the share price allows investors to identify patterns and assess the company’s resilience over time.

C. Expert Opinions Experts often provide valuable perspectives on market trends. We’ll explore what financial analysts and experts have to say about Five Star Finance’s share price.

V. Key Factors Affecting Five Star Finance Share Price

A. Financial Reports and Statements Diving deep into the company’s financial reports and statements is crucial for understanding its financial health and predicting future performance.

B. Market Competition The competitive landscape significantly influences share prices. We’ll explore how Five Star Finance compares to its industry peers and competitors.

C. Economic Indicators Macro-economic factors can impact the overall market and, consequently, the share prices of companies. We’ll examine how economic indicators affect Five Star Finance.

VI. How to Interpret Five Star Finance Share Price

A. Understanding Stock Market Terminology Investors need a solid understanding of stock market terminology to interpret share prices accurately. We’ll provide a comprehensive guide to key terms.

B. Analyzing Price Movements Price movements tell a story. We’ll guide investors on how to analyze these movements effectively for better decision-making.

VII. Tips for Investors

A. Research and Due Diligence Thorough research and due diligence are the cornerstones of successful investing. We’ll provide actionable tips for investors to conduct effective research.

B. Diversification Diversifying one’s investment portfolio is a prudent strategy. We’ll explore how diversification can mitigate risks associated with share price volatility.

C. Long-term vs. Short-term Strategies Investors need to align their strategies with their financial goals. We’ll discuss the advantages and disadvantages of long-term and short-term investment approaches.

VIII. Case Studies

A. Successful Investments in Five Star Finance Analyzing successful investment stories can provide valuable lessons for investors looking to replicate similar successes.

B. Lessons Learned from Unsuccessful Investments Learning from past mistakes is equally important. We’ll dissect cases where investors faced challenges with Five Star Finance’s share price.

IX. Expert Insights

A. Interviews with Financial Experts Engaging insights from financial experts can offer a unique perspective on the future trajectory of Five Star Finance’s share price.

B. Predictions and Forecasts Experts often provide predictions and forecasts based on their analysis. We’ll share insights from industry experts on what the future might hold.

X. Recent News and Developments

A. Impact on Share Prices News and developments can have a significant impact on share prices. We’ll explore recent events and their implications for Five Star Finance.

B. Investor Sentiment Understanding investor sentiment is crucial for anticipating market reactions to news and developments.

XI. Risks and Challenges

A. Potential Pitfalls for Investors Investors must be aware of potential pitfalls. We’ll highlight common risks associated with investing in Five Star Finance and strategies to mitigate them.

B. Mitigation Strategies Providing practical strategies to mitigate risks ensures that investors are well-prepared for challenges in the market.

XII. Comparisons with Competitors

A. Industry Analysis Comparing Five Star Finance with its competitors offers a comprehensive view of its market positioning and relative performance.

B. Relative Performance in the Market Understanding how Five Star Finance fares against competitors provides insights into its competitive advantages and challenges.

XIII. FAQs about Five Star Finance Share Price

A. Common Queries from Investors Answering frequently asked questions helps provide clarity to potential investors navigating the intricacies of Five Star Finance’s share price.

B. Expert Responses Expert responses to common queries add credibility and authority to the information provided.

XIV. Conclusion

In conclusion, understanding Five Star Finance’s share price requires a holistic approach. By considering historical data, expert opinions, and market trends, investors can make more informed decisions.

Investing in the stock market is a journey of continuous learning and adaptation. By staying informed and vigilant, investors can navigate the complexities of share prices with confidence.

FAQs about Five Star Finance Share Price

- Q: How often should I check Five Star Finance share prices? A: Regular monitoring is advisable, but the frequency depends on your investment strategy. Long-term investors may check less frequently than those with a short-term focus.

- Q: What role does market sentiment play in determining share prices? A: Market sentiment can significantly impact share prices. Positive sentiment may drive prices up, while negative sentiment can lead to declines.

- Q: Are there any upcoming events that could influence Five Star Finance share prices? A: Stay updated on earnings reports, industry developments, and macro-economic events, as they can all influence share prices.

- Q: How do economic indicators impact the share prices of companies like Five Star Finance? A: Economic indicators, such as GDP growth and inflation rates, can influence overall market sentiment, affecting share prices.

- Q: What’s the best strategy for mitigating risks associated with investing in Five Star Finance? A: Diversification, thorough research, and staying informed about market trends are essential strategies for mitigating risks in stock investments.