Introduction:

ARC Finance has been a prominent player in the financial markets, attracting investors with its innovative approach and steady growth. As we look ahead to 2025, it’s natural for investors to wonder about the potential share price target for ARC Finance. In this article, we will delve into the factors that could influence ARC Finance’s performance and attempt to project a share price target for the year 2025.

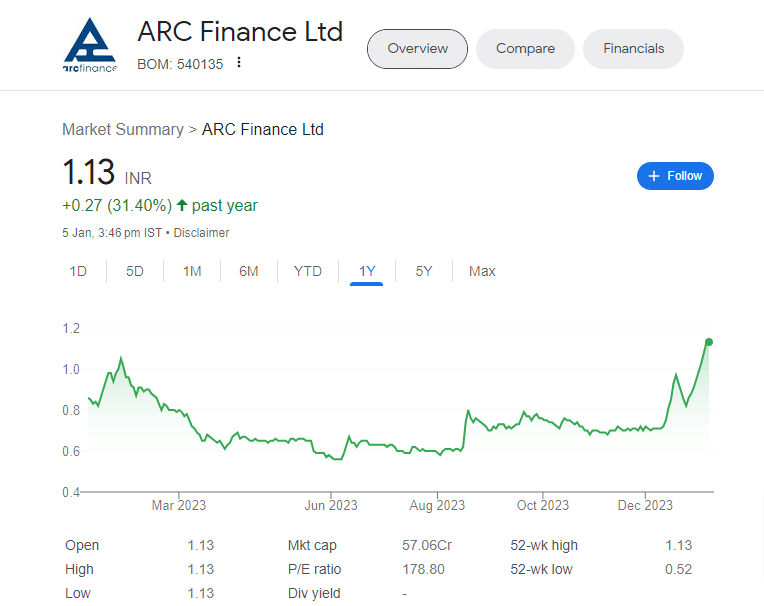

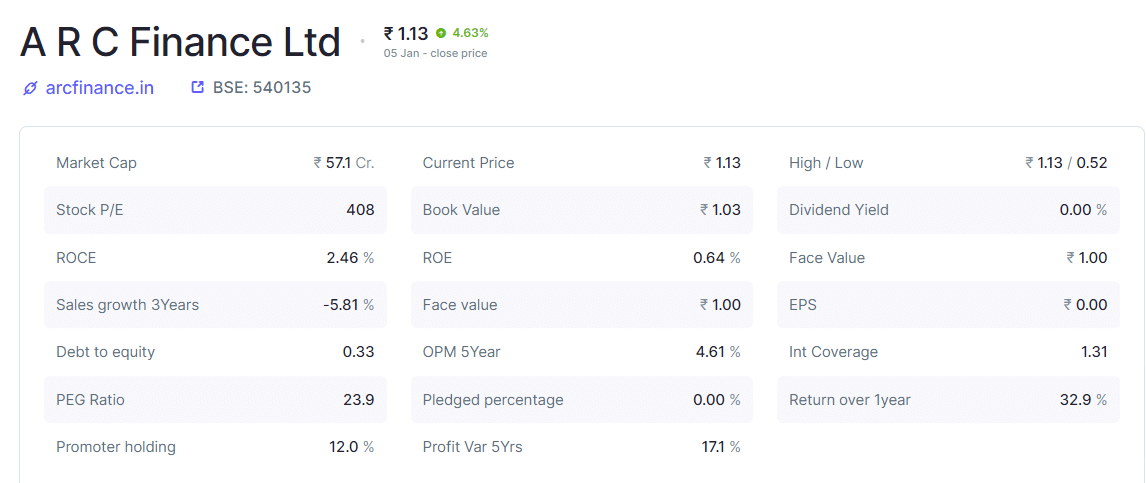

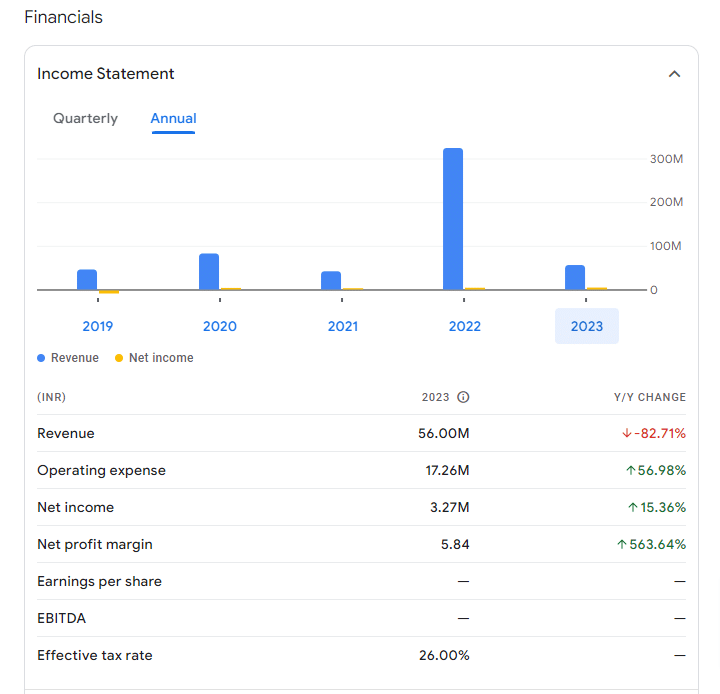

- Historical Performance: To understand where ARC Finance might be headed, it’s crucial to examine its historical performance. Analyzing past trends in revenue, profits, and market share can provide valuable insights into the company’s trajectory.

- Industry Trends: The financial industry is dynamic, and external factors such as economic conditions, regulatory changes, and technological advancements can significantly impact a company’s performance. A thorough examination of current industry trends will help in gauging the challenges and opportunities that ARC Finance may encounter.

- Financial Metrics: Delving into key financial metrics is essential for a comprehensive analysis. This includes studying metrics like earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE). These metrics can offer a clearer picture of the company’s financial health.

- Innovation and Expansion: ARC Finance’s commitment to innovation and strategic expansion plans play a pivotal role in determining its future growth. Investors should closely follow any announcements related to new products, partnerships, or market entries that could impact the company’s share price.

- Market Sentiment: Investor sentiment is a powerful force in the stock market. Monitoring news, social media, and expert opinions can provide insights into how the market perceives ARC Finance. Positive sentiment can drive demand, potentially influencing the share price.

Understanding Five Star Finance Share Price: A Comprehensive Guide

- Risk Factors: No investment is without risks, and identifying potential pitfalls is crucial. Examining risk factors such as market volatility, competition, and regulatory challenges will contribute to a more realistic assessment of ARC Finance’s future prospects.

- Analyst Projections: Keeping an eye on analyst projections can offer additional perspectives. Analysts often provide forecasts based on in-depth research and market knowledge. While individual projections may vary, an average consensus can be a valuable reference point.

Conclusion:

In conclusion, predicting the exact share price for ARC Finance in 2025 is inherently uncertain due to the complexities of the financial markets. However, a thorough analysis of historical performance, industry trends, financial metrics, innovation, market sentiment, risk factors, and analyst projections can collectively contribute to forming a well-informed perspective. Investors are advised to approach such projections with a degree of caution, considering the inherent unpredictability of the stock market. As always, it’s recommended to consult with financial experts and conduct personal research before making investment decisions.