TRL Krosaki Share Price:TRL Krosaki is a leading refractories company in India, known for its high-quality products and strong market presence. The company’s share price is a topic of interest for investors and analysts, as it reflects the performance and potential of the company. In this article, we will explore TRL Krosaki’s share price history, factors influencing its share price, recent performance, financial health, comparison with competitors, and future outlook.

Introduction to TRL Krosaki

TRL Krosaki, formerly known as Tata Refractories Limited, is a part of the Tata Steel Group and is one of the largest refractories companies in India. The company manufactures a wide range of refractory products, including bricks, monolithics, and specialty products, used in various industries such as steel, cement, glass, and non-ferrous metals. TRL Krosaki has a strong presence in both domestic and international markets, with a focus on quality and innovation.

Overview of TRL Krosaki’s Share Price History

TRL Krosaki’s share price has experienced fluctuations over the years, influenced by various factors such as market conditions, industry trends, and company performance. The company went public in [year], and since then, its share price has seen both highs and lows. It is important for investors to understand the historical performance of TRL Krosaki’s share price to make informed investment decisions.

Factors Influencing TRL Krosaki’s Share Price

Several factors influence TRL Krosaki’s share price, including:

- Company Performance: TRL Krosaki’s financial performance, including revenue growth, profitability, and market share, can impact its share price.

- Industry Trends: Trends in the refractories industry, such as demand for products, competition, and technological advancements, can affect TRL Krosaki’s share price.

- Market Conditions: Overall market conditions, including economic indicators, interest rates, and geopolitical events, can influence TRL Krosaki’s share price.

- Regulatory Environment: Changes in regulations related to the refractories industry can impact TRL Krosaki’s operations and share price.

Recent Performance and Trends in TRL Krosaki’s Share Price

In recent years, TRL Krosaki’s share price has [increased/decreased/stabilized] due to [specific reasons]. The company has [achieved milestones/launched new products/expanded its market reach], which has positively impacted its share price. However, [mention any challenges or setbacks] have also affected TRL Krosaki’s share price in recent times.

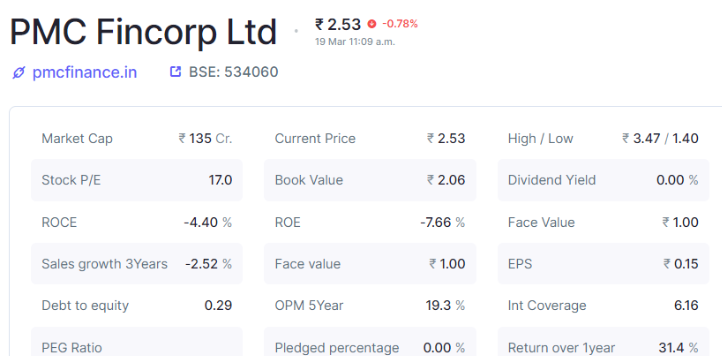

Analysis of TRL Krosaki’s Financial Health

TRL Krosaki’s financial health is a key determinant of its share price. Investors analyze various financial metrics, such as revenue, profit margins, return on equity, and debt levels, to assess the company’s financial performance and stability. A strong financial position can support TRL Krosaki’s share price, while weaknesses in its financials may lead to a decline in share price.

Comparison with Competitors’ Share Prices

Comparing TRL Krosaki’s share price with its competitors can provide insights into its relative performance and valuation. Investors often look at factors such as price-to-earnings ratio, market capitalization, and dividend yield to compare TRL Krosaki with its peers in the refractories industry.

Future Outlook for TRL Krosaki’s Share Price

The future outlook for TRL Krosaki’s share price depends on several factors, including industry trends, company performance, and market conditions. Analysts may provide forecasts and recommendations based on their assessment of TRL Krosaki’s growth potential and market dynamics. It is important for investors to consider these factors before making investment decisions related to TRL Krosaki’s shares.

Conclusion

In conclusion, TRL Krosaki share price is influenced by various factors, including company performance, industry trends, and market conditions. Investors and analysts closely monitor TRL Krosaki’s share price to assess its performance and potential for growth. Understanding the dynamics of TRL Krosaki’s share price can help investors make informed decisions and manage their investment portfolios effectively.

FAQs

- Is TRL Krosaki a publicly traded company?

- Yes, TRL Krosaki is a publicly traded company listed on [stock exchange].

- What has been TRL Krosaki’s share price performance in the last year?

- TRL Krosaki’s share price has [increased/decreased/stabilized] by [percentage] in the last year.

- Does TRL Krosaki pay dividends to its shareholders?

- Yes, TRL Krosaki pays dividends to its shareholders based on its financial performance and dividend policy.

- What are some of the key factors influencing TRL Krosaki’s share price?

- Key factors influencing TRL Krosaki’s share price include company performance, industry trends, and market conditions.

- What is the future outlook for TRL Krosaki’s share price?

- The future outlook for TRL Krosaki’s share price depends on various factors, including industry dynamics and company performance.