Titagarh Wagons Share Price Target 2025:Titagarh Wagons Limited is a leading railway wagon manufacturer in India, with a strong presence in the domestic and international markets. The company has a rich history of over 70 years and is known for its innovative products and commitment to quality.

Overview of Titagarh Wagons’ Performance

Titagarh Wagons has shown steady growth over the years, driven by its focus on product diversification and expansion into new markets. The company has a strong order book and is well-positioned to capitalize on the growing demand for railway wagons in India and abroad.

Lloyds Steel Share Price Target 2024, 2025, 2026, 2027, 2028, 2029, 2030, 2040

Factors Affecting Titagarh Wagons’ Share Price

Market Trends

The share price of Titagarh Wagons is influenced by various market trends, including changes in demand for railway wagons, economic conditions, and investor sentiment.

Company Performance

Titagarh Wagons’ share price is also affected by its financial performance, including revenue growth, profitability, and return on investment. Positive performance indicators can lead to an increase in share price.

Industry Outlook

The outlook for the railway wagon industry plays a significant role in determining Titagarh Wagons’ share price. Factors such as government policies, infrastructure development, and technological advancements in the industry can impact the company’s performance.

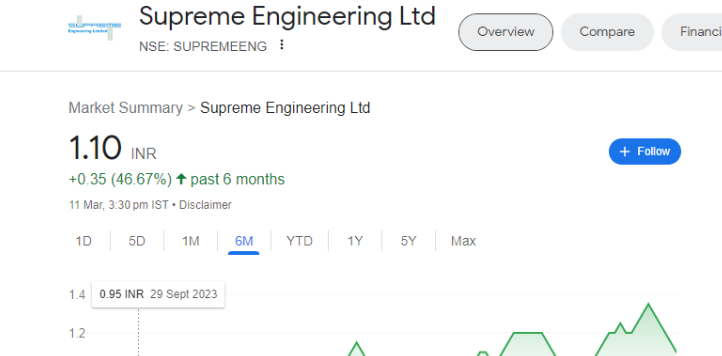

Supreme engineering (SUPREMEENG) share price target 2025

Analysis of Titagarh Wagons’ Share Price Target for 2025

Based on current market trends and Titagarh Wagons’ performance, analysts predict a positive outlook for the company’s share price in 2025. The first target for Titagarh Wagons’ share price is estimated to reach ₹2600, reflecting a potential upside from the current levels. The second target is even more bullish, with a projected share price of ₹2900 by 2025.

Titagarh Wagons Share Price Target 2025

| Titagarh Wagons Share Price Target | Share Price Target |

| Titagarh Wagons Share Price Target 2024 | ₹1100 |

| Titagarh Wagons Share Price Target 2025 | ₹1300 |

| Titagarh Wagons Share Price Target 2026 | ₹1900 |

| Titagarh Wagons Share Price Target 2027 | ₹2500 |

| Titagarh Wagons Share Price Target 2028 | ₹3000 |

| Titagarh Wagons Share Price Target 2029 | ₹3700 |

| Titagarh Wagons Share Price Target 2030 | ₹4800 |

Conclusion

In conclusion, Titagarh Wagons is poised for growth in the coming years, driven by its strong fundamentals and market position. With a positive outlook for the railway wagon industry and the company’s performance, investors can consider Titagarh Wagons as a potential investment opportunity.

FAQs

What is the current share price of Titagarh Wagons?

As of [date], the share price of Titagarh Wagons is [current share price].

What are the key factors driving Titagarh Wagons’ growth?

Titagarh Wagons’ growth is driven by factors such as product innovation, market expansion, and strong order book.

Is Titagarh Wagons a profitable investment?

Investment in Titagarh Wagons can be profitable, considering its strong performance and growth prospects.

What are the risks associated with investing in Titagarh Wagons?

Risks associated with investing in Titagarh Wagons include market volatility, regulatory changes, and competition.

How can I invest in Titagarh Wagons?

Investors can buy Titagarh Wagons’ shares through stock exchanges or consult a financial advisor for guidance.