Yes bank made accelerated provision of rs. 5240 cr at the end of March quarter compared to Rs. 4872 crore a year ago and Rs. 2199 crore in the previous quarter.

Private sector lender Yes bank on Friday reported a higher than expected loss of Rs. 3788 crore at the end of the march quarter for the fiscal year 2020-21 because of higher provision.

The bank reported a net loss of rs. 3688 crore a year ago and a net profit of Rs.151 crore last quarter.

Yes bank made an accelerated provision of Rs. 5240 crore at the end of March quarter compared to Rs. 4872 crore a year ago and Rs. 2199 in the previous quarter.

Gross non-performing assets as a percentage of total loans stood at 15.4 % at the end of March quarter compared to 15.3% in the previous quarter. The bank added bad loans of Rs. 11889 crore during the quarter.

Operationally Yes bank net interest income declined by 22.5% to Rs.987 crore as of 31 March 2021. Non-interest income rose 36.6% to Rs.816 crore at the end of March compared to Rs.597 crore a year ago.

The bank plans to grow its transactional banking Business Faster than the lending Business, Kumar said.

>>YES BANK Financial Results for the financial year ended March 31, 2021 PDF Click here

Yes Bank Profit And Loss Rs. Crores

| MARCH 2019 | MARCH 2020 | MARCH 2021 | |

| Revenue | 29624 | 26052 | 20039 |

| Net Profit | 1709 | -16433 | -3489 |

| EPS in Rs. | 7.38 | -13.09 | -1.39 |

| Dividend Payout | 27% | 0% | 0% |

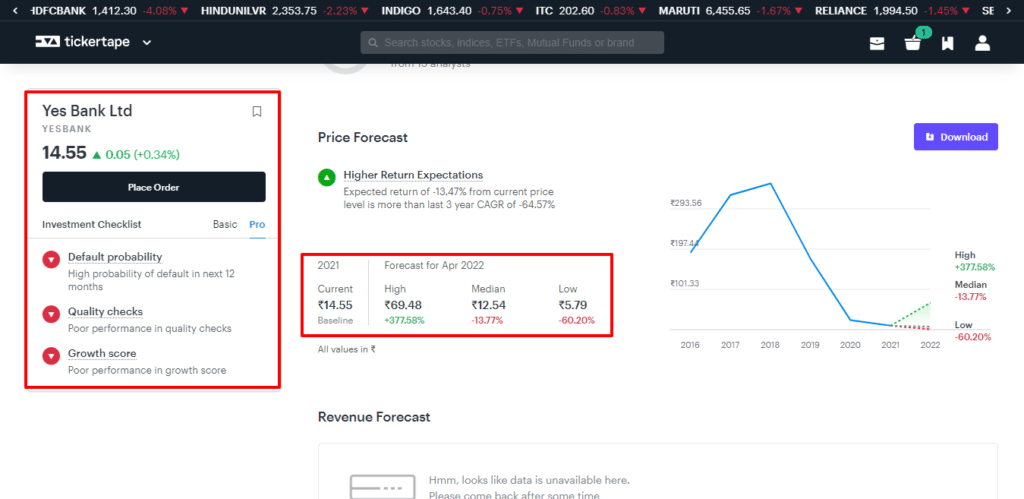

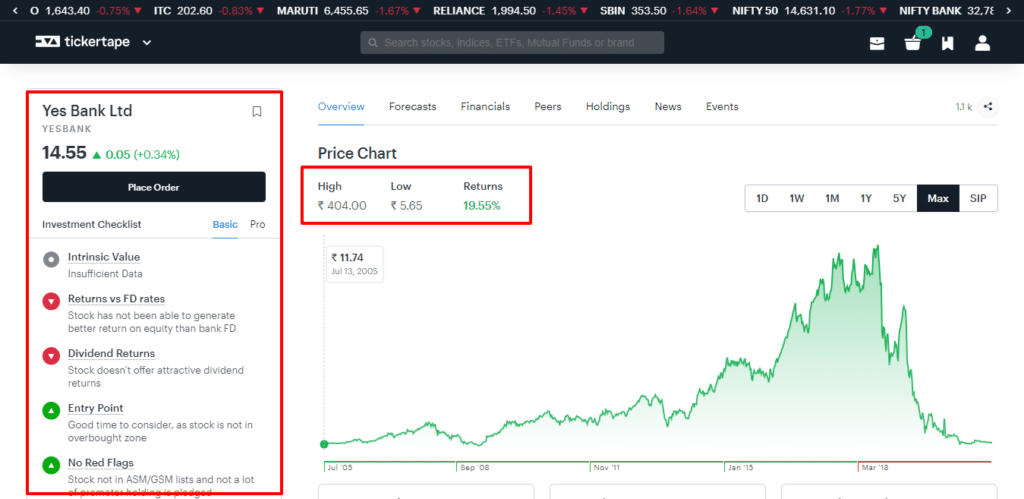

YES BANK CAGR

| 10 Years | -13% |

| 5 Years | -40% |

| 3 Years | -65% |

| 1 Year | -48% |

YES BANK SHAREHOLDING PATTERN Up to 2021

| Sep 2020 | Dec 2020 | Mar 2021 | |

| Promoters | 0.00 | 0.00 | 0.00 |

| FIIs | 11.16 | 15.01 | 13.77 |

| DIIs | 49.28 | 47.34 | 46.71 |

| Public | 39.56 | 37.65 | 39.52 |

YES BANK ANALYSIS 2021

>>YES BANK TARGET 69.48 until April 2022