The stock market is a dynamic and ever-evolving entity, influenced by various factors that shape its daily operations. One crucial aspect that investors and traders need to consider is the occurrence of stock market holidays. In this article, we will delve into the significance of stock market holidays, their impact on equities, and provide insights into planning around market closures.

Understanding Stock Market Holidays

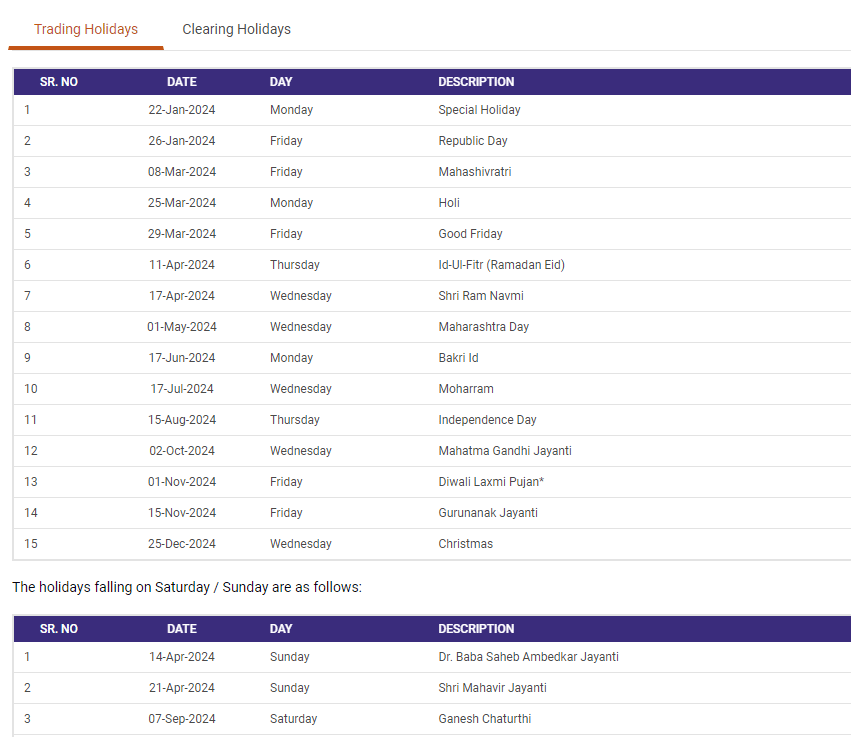

Stock market holidays are days when financial markets are closed, suspending trading activities. In the calendar year 2024, two significant holidays stand out: Mahatma Gandhi Jayanti on October 2, 2024, and Diwali Laxmi Pujan on November 1, 2024.

Impact on Equities

The closure of the stock market on holidays has far-reaching implications for equities. Traders and investors must adopt specific strategies to navigate these closures successfully. Whether it’s adjusting investment portfolios or planning trades around these dates, understanding the impact on equities is crucial.

Historical Trends

Looking back at historical market behavior during holidays provides valuable insights. Analyzing trends helps traders make informed decisions, considering factors such as market reactions before and after holidays.

Planning Around Market Closures

Effective planning is key when it comes to stock market holidays. Investors should schedule investments and trades strategically, considering the potential market volatility during holiday periods.

Recognizing Market Volatility

Post-holiday market reopenings can often be accompanied by increased volatility. Investors need to recognize and navigate this volatility to make sound financial decisions.

Calendar Dates for 2024

For a comprehensive approach, here are the key dates for stock market holidays in 2024. Understanding these dates will empower investors to plan their financial activities more efficiently.

- Mahatma Gandhi Jayanti: October 2, 2024

- Diwali Laxmi Pujan: November 1, 2024

Global Perspectives

Stock market holidays vary across countries, impacting global investors differently. It’s essential for international investors to consider these variations when making investment decisions.

Industry-specific Observations

Different industries may be affected in various ways by stock market closures. Tailoring investment strategies based on industry-specific trends can help investors maximize their returns.

Investor Preparedness

Staying informed about upcoming market closures is critical for investor preparedness. Utilizing resources to keep track of holiday schedules ensures that investors are not caught off guard.

Case Studies

Examining real-life examples of market movements during holidays provides practical insights. Case studies offer valuable lessons that investors can apply to their own strategies.

Mitigating Risks

Strategies for risk management during holiday periods are essential. Balancing risk and reward is particularly crucial when navigating the potential challenges posed by market closures.

Future Trends

Looking ahead, the nature of stock market holidays is expected to evolve. Technological advancements and changing market dynamics will likely influence future trends.

Expert Opinions

Gaining insights from financial experts is invaluable. Expert opinions on navigating stock market holidays and their recommendations can guide investors in making informed decisions.

Conclusion

In conclusion, understanding and planning around stock market holidays are integral aspects of successful investing. By recognizing historical trends, mitigating risks, and staying informed, investors can navigate market closures with confidence. As we approach the calendar year 2024, it’s essential for every investor to incorporate these considerations into their financial strategies.

Frequently Asked Questions:

- Q: How do stock market holidays impact trading activity?

- A: Stock market holidays lead to the suspension of trading activities, influencing market dynamics and investor behavior.

- Q: What strategies can investors use to navigate market closures?

- A: Investors can plan their trades strategically, adjust portfolios, and stay informed about upcoming holidays to navigate market closures effectively.

- Q: Are stock market holidays the same globally?

- A: No, stock market holidays vary across countries, affecting global investors differently.

- Q: How can investors mitigate risks during holiday periods?

- A: Strategies for risk management include balancing risk and reward, staying informed, and adopting industry-specific approaches.

- Q: What role do expert opinions play in navigating stock market holidays?

- A: Expert opinions provide valuable insights and recommendations, guiding investors in making informed decisions during market closures.