Hello, friends In this blog we will discuss the Stock market indicator which is available in the stock market and its performance in detail so let’s start the blog.

what is the stock market Indicator?

Stock market Indicator means it is an indicator that gives information in a specific way that will help us to increase trading style.

The indicator gives good information in a specific way.

There are many indicators available in the market but every Indicator has some different specification so understand every indicator first then Invest.

Free Stock Market Indicator List

- Relative Strength Index (RSI)

- Moving Average

- Volume

- Bollinger Bands

- FIB Retracement

- Camarilla Indicator

- Average Directional Index (ADX)

- Pivot point Standard

- Stocastic

- etc.

All these indicators I will explain in a separate blog every time.

RELATIVE STRENGTH INDEX (RSI)

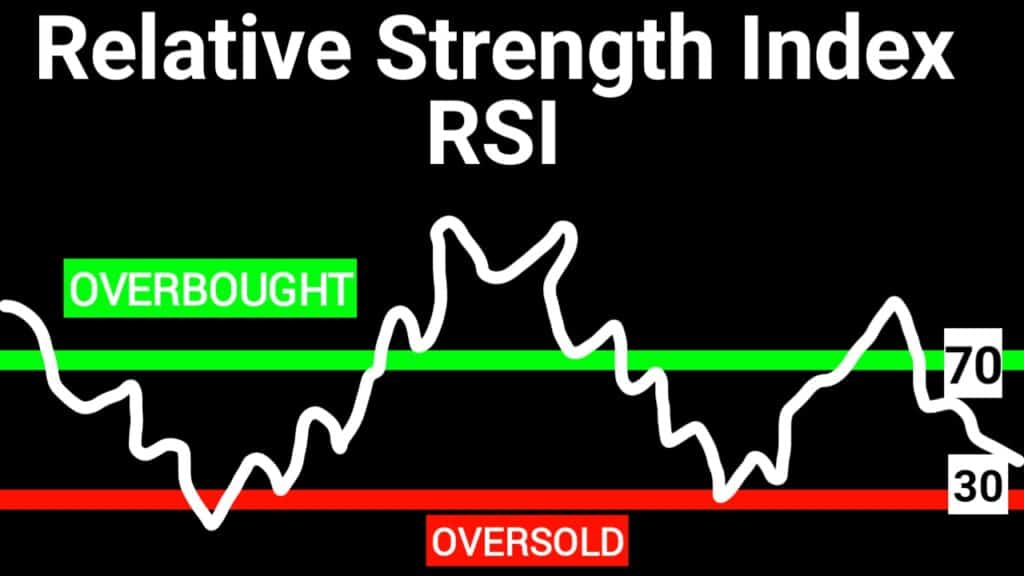

RELATIVE STRENGTH INDEX (RSI) is a momentum indicator used in technical analysis that measures the magnitude of recent price changes to evaluate the overbought or oversold conditions in the price of a stock or other asset.

RSI indicator display like as oscillator and can have read from 0 to 100.

The Rsi indicator was developed by J. Welles Wilder Jr. and introduced in his seminal 1978 book,” New Concept in Technical Trading System”

The RSI provides technical traders with signals about bullish and bearish price momentum.

>Note-

- if RSI is above 70% then it is called the overbought Condition.

- If RSI is Below 30% then it is called Oversold Condition.

- If RSI is Between 30% to 70% then market is in consolidated period.